There is a specific kind of quiet that happens late at night when the kids are finally asleep, and the house stops humming. It is usually the time when parents sit down at the kitchen table, look at a laptop screen, and start wondering how they are going to make the big things happen. We all have those dreams. Maybe it is a summer spent exploring the coast, or the mounting reality of tuition fees, or even just the peace of mind that comes with a solid emergency fund.

The challenge with family budgeting is that it never feels like a math problem. It feels like a series of choices between the life you want to give your children and the numbers staring back at you from a spreadsheet. When you are looking at big goals, the mountain can seem too high to climb. However, breaking those goals down into manageable steps makes the summit feel a lot closer.

Defining Your Family North Star

Before you look at a single bank statement, you have to talk about what actually matters to your family. Not every goal is created equal. Some families value experiences and travel above all else. Others feel a deep sense of urgency regarding education or a forever home.

Sit down together and list your top three priorities. Is it a trip to see grandparents across the country? Is it a college fund that grows a little every month? Is it a new car that fits everyone comfortably without a struggle? When you identify your North Star, saying no to smaller, impulsive purchases becomes much easier. You are not just restricting your spending. You are choosing your future.

The Power of the Dedicated Account

One of the hardest parts of saving for a long-term goal is seeing that money sit in your everyday checking account. It is tempting to dip into it for a weekend pizza or a new pair of shoes when it is right there in front of you. The most effective way to protect your goals is to move that money out of sight.

Separate accounts for separate goals create a psychological barrier that works in your favor. Many people find success by opening a new account specifically for their bonuses or windfalls. For example, looking into options like a Sofi checking account bonus for new users can give you a small head start just for organizing your finances better. When you see a balance growing in an account labeled “Italy Trip” or “Tuition,” you feel a sense of momentum that a general savings account just cannot provide.

Small Changes with Big Impact

We often think that saving for a big goal requires a massive lifestyle overhaul. While big cuts help, the consistency of small changes is what actually builds the foundation. Review your recurring subscriptions. Most families are paying for at least two streaming services they do not watch or a gym membership that has not been used since January.

Another area to look at is the grocery bill. Meal planning is not just about eating healthy. It is about preventing that fifty-dollar grocery run on a Wednesday because you did not have a plan for dinner. Those mid-week trips are budget killers. If you can save one hundred dollars a month through better planning, that is over a thousand dollars a year toward your big goal.

Involving the Whole Family

If your kids are old enough to ask for toys, they are old enough to understand the concept of a family goal. You do not need to share the stress of the mortgage, but you can share the excitement of the reward.

Create a visual tracker on the refrigerator. Whether it is a thermometer you color in or a jar of marbles, seeing the progress makes the goal real for everyone. When kids see that skipping a few small treats helps the family get closer to the big vacation, they learn the value of delayed gratification. It turns budgeting from something parents do in secret into a team sport.

Planning for the Unexpected

The biggest threat to any long-term savings plan is the unexpected expense. The water heater breaks or the car needs new tires, and suddenly, the vacation fund is empty again. This is why a small buffer is essential.

Before you go all in on your big goals, ensure you have a “life happens” fund. Even five hundred dollars tucked away can be the difference between a minor inconvenience and a total budget collapse. It provides the breathing room you need to keep your long-term goals on track when life gets messy.

The Long Game

Saving for big family goals is a marathon. There will be months where you save more than expected and months where you save nothing at all. The key is to keep coming back to the table. Do not let one bad month derail the entire plan.

When you finally reach that goal, whether it is walking onto a plane or making that final tuition payment, the feeling of accomplishment belongs to the whole family. You proved that with a little bit of focus and a lot of heart, you can build the life you imagined.

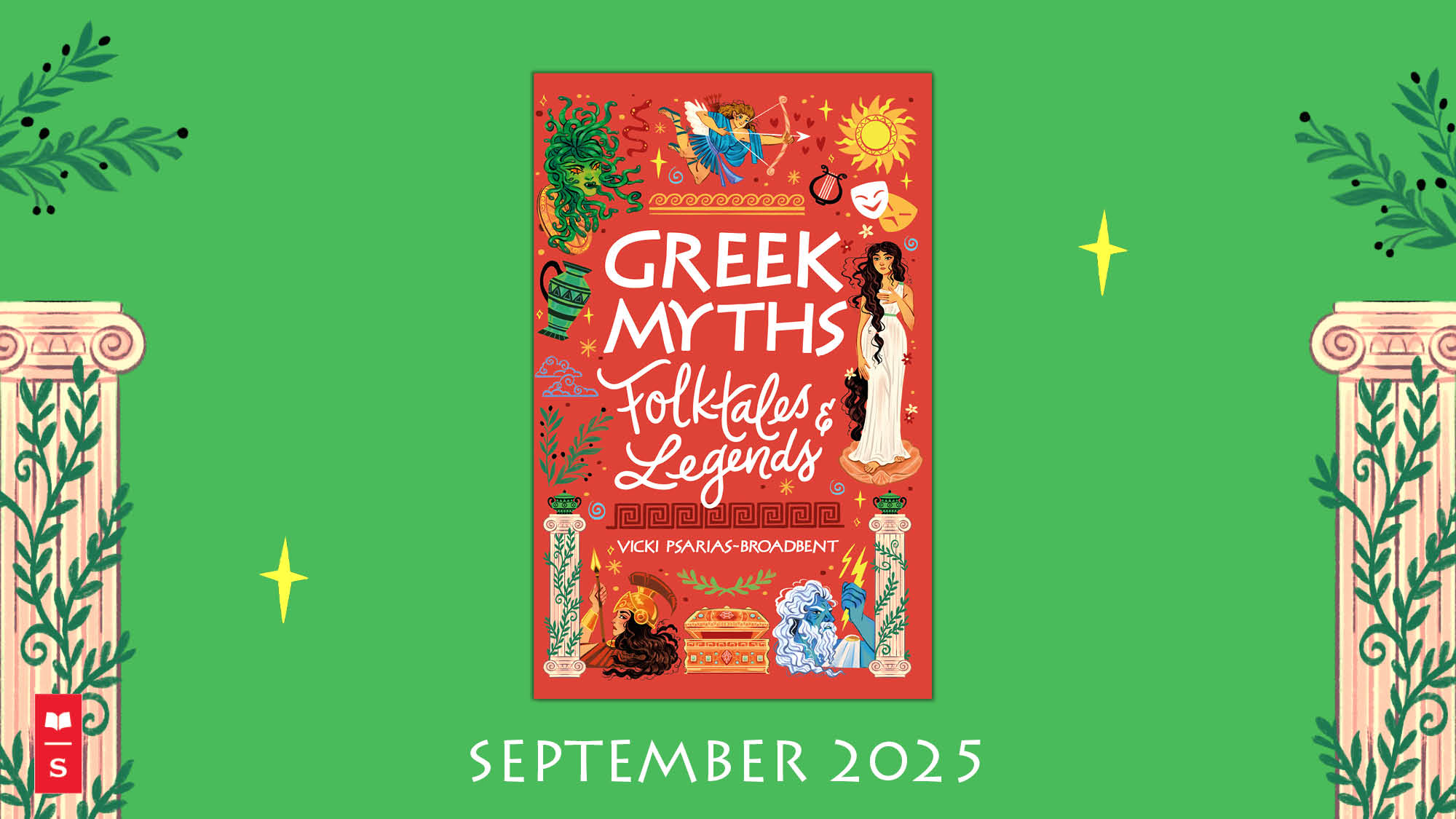

Pre-order my debut children’s book

Greek Myths, Folktales & Legends for 9-12 year olds

Published by Scholastic. Available on Amazon

Disclaimer: This content was automatically imported from a third-party source via RSS feed. The original source is: https://honestmum.com/budgeting-for-big-family-goals-saving-for-trips-school-and-more/. xn--babytilbehr-pgb.com does not claim ownership of this content. All rights remain with the original publisher.