So why write this post (it’s not very British, is it) and why now?

Because when you’re knee-deep in a forever-home renovation, money stops being theoretical very quickly. It becomes receipts, quotes, revised quotes, and that familiar internal negotiation of “is this essential or just emotionally convincing?”

If you’ve been following along here, you’ll know we’ve moved back up North to Yorkshire after time spent down South in Windsor, and we’re firmly in that stage of life where home decisions feel permanent, or at least expensive enough to warrant serious thought. Renovating has a way of sharpening your financial instincts. Every choice forces you to ask not just what does this cost, but how is this priced.

And that distinction matters more than I realised.

In Yorkshire, estate agent fees don’t usually come wrapped in dramatic headlines. We’re not dealing with a blunt, headline-friendly five percent. Instead, we’re more likely to see something like a sole agency fee hovering around the low-to-mid one percent range, a higher multi-agency rate, or increasingly, a fixed or flat-fee option offered by online or hybrid agents.

On paper, none of that sounds outrageous.

And that’s exactly why it’s easy to switch off.

What finally clicked for me wasn’t the number itself. It was the structure behind it.

A percentage fee rises automatically with the value of the home. A fixed fee doesn’t. The difference between the two isn’t just arithmetic. It’s psychological. One scales quietly. The other stays put.

That realisation landed for me in much the same way as it has during this renovation process. You start with something sensible and contained. Then the context shifts. The base numbers grow. And suddenly a pricing model that once felt reasonable deserves a second look.

I’ve written before about how important it is to talk openly about money at home, particularly when it comes to normalising financial conversations with children and family. The same principle applies here. Avoiding the mechanics of pricing doesn’t make decisions easier. It just makes them less transparent.

This is where my thinking was pushed further after reading a detailed analysis of how commission structures operate in markets where property values have risen dramatically, such as Toronto. While the UK and Canada obviously operate under different systems, the comparison is still useful because it strips the conversation back to fundamentals.

When home values double, percentage-based fees double with them. Fixed fees do not.

The Toronto example lays this out clearly by showing how commission amounts have ballooned over time, not because the percentage changed, but because the underlying prices did. The maths behaves the same way everywhere, even if the headline rates differ. You can see that breakdown here in a clear explainer on how commission structures scale as property values rise.

What struck me was how rarely we are encouraged to pause and ask whether the way something is priced still makes sense in today’s context. Particularly when the market has moved faster than wages, savings, or general inflation.

Running a business has trained me to interrogate this instinctively. I’ve written at length about building something sustainable rather than just habitual, and one of the biggest lessons is that price and value are not the same thing. They need to be revisited as circumstances change.

This doesn’t mean percentage-based fees are inherently wrong. Nor does it mean flat-fee models are automatically better. What it does mean is that structure matters, and that understanding how a fee is calculated is just as important as knowing the rate itself.

These are the questions I now find myself asking whenever commission comes up, whether for selling, buying, or advising friends who are doing either:

What does this fee look like in actual pounds?

How does it change if the sale price shifts?

What services are genuinely included at that price point?

And crucially, is the cost rising because the work has expanded, or simply because the base number has?

That last question has become my anchor.

Because once you stop focusing on the percentage and start focusing on how the pricing model behaves over time, you regain clarity. You move from assumption to understanding. From politeness to confidence.

If you’re navigating a move, a sale, or even just trying to make sense of how the property market works where you live, my advice is simple and hard-earned: look past the headline rate. Translate everything into real money. Ask how the structure works, not just what the number is.

Commission isn’t really about the percentage at all.

It’s about how that number moves when everything else does.

And knowing that puts you back in the driving seat.

As always, I’d love to hear your thoughts in the comments. Talking openly about money, especially when it feels awkward, is often where the most useful clarity begins.

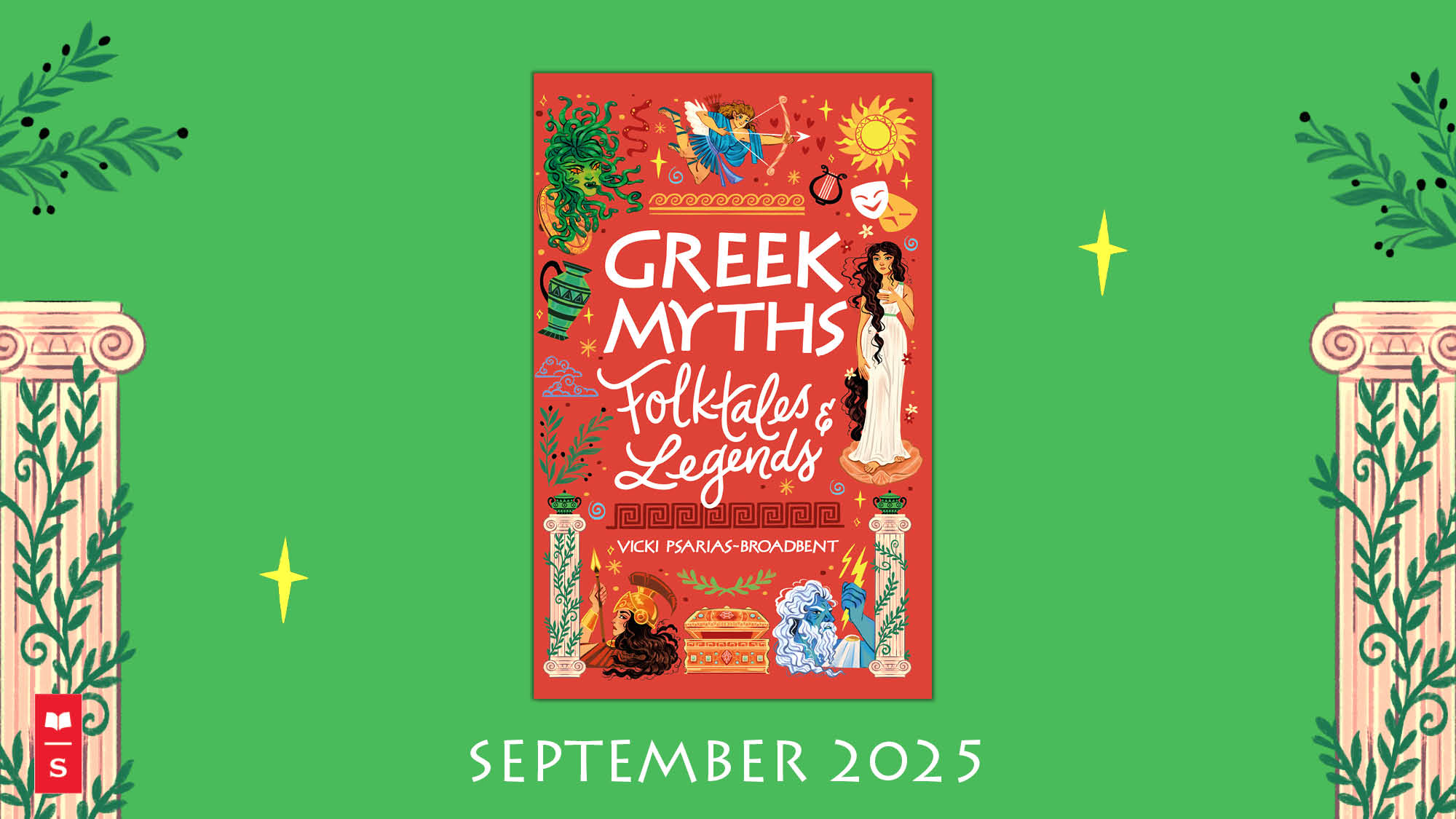

Pre-order my debut children’s book

Greek Myths, Folktales & Legends for 9-12 year olds

Published by Scholastic. Available on Amazon

Disclaimer: This content was automatically imported from a third-party source via RSS feed. The original source is: https://honestmum.com/the-moment-i-realised-commission-isnt-really-about-the-percentage/. xn--babytilbehr-pgb.com does not claim ownership of this content. All rights remain with the original publisher.