Start Smart: The Roadmap for a Durable and Scalable Financial Structure

When you’re launching a new business—or even thinking about it—your focus often lands on the product, the marketing strategy, or the name of the brand. But if you skip over one of the most critical components—your financial structure—you risk building on shaky ground. A smart financial framework doesn’t just help you get started; it helps you survive uncertainty, scale sustainably, and attract future investors.

Consider this article as a roadmap for setting up a strong, scalable financial base. Each section covers a core principle that can help make your financial setup smarter, more efficient, and easier to grow over time.

Understand Your Savings Options Early

When you’re starting out, it’s tempting to think only in terms of expenses. But what about savings? Don’t neglect this aspect, as it plays a major role in keeping your business resilient. One of the first financial tools every entrepreneur should understand is interest—especially the difference between simple and compound interest.

Simple interest earns money only on the principal. Compound interest, on the other hand, earns interest on both the initial deposit and the accumulated interest. Over time, that difference becomes massive. If you’re setting aside capital—whether it’s from early profits or personal funds—putting it into a compound interest account can multiply your savings with zero extra effort.

Using an online compounding interest calculator can show you exactly how your savings will grow over time. It’s a great way to visualize the power of disciplined saving.

Choose the Right Business Structure for Financial Clarity

Your legal structure influences more than your taxes. It affects how you pay yourself, how you’re taxed, what kind of funding you can get, and what kind of liability you carry. A sole proprietorship is easy to start, but it offers no personal protection. An LLC adds a layer of separation between your personal and business assets, and a corporation brings even more structure—but with added complexity.

Choosing the right structure from the start helps prevent confusion later. It also impacts how clean your financial records are and whether or not investors take you seriously. When your business structure supports your goals, it’s easier to scale and easier to manage your responsibilities.

Separate Business and Personal Finances

This one is simple. Blending your personal and business finances creates confusion and risk. It makes it hard to track your spending, messes up your taxes, and can even put your personal assets in danger.

Open a business checking account as soon as you launch. Use it for every business transaction, no matter how small. Get a business credit card for expenses. Keep receipts and records. The more clearly you separate your finances, the easier it becomes to analyze performance, prepare for taxes, and manage growth.

Build a Budget That Works—and Update It Regularly

Many new founders either ignore budgeting or build one and never look at it again. Both approaches are mistakes. A working budget gives you the control and insight you need to make smart financial choices. Start with your fixed costs, estimate your variable costs, and forecast your revenue. Then, review and adjust your budget every month.

Your budget isn’t just a forecast—it’s a tool for accountability. When your actual spending starts to drift from your plan, it forces you to ask why. Maybe you’re growing faster than expected. Maybe costs are creeping up in unnoticed areas. Whatever the case, a good budget helps you stay in control and make intentional decisions.

Plan for Cash Flow, Not Just Profit

Profit is not always enough to keep your business running. Cash flow is what actually pays the bills, covers payroll, and keeps your operations moving smoothly. You might show a profit on paper while still struggling to meet your obligations if your money isn’t flowing in at the right times.

You must understand, therefore, how cash moves in and out ofyour business. Track your accounts receivable closely—late payments can break a small business. Make sure you’re invoicing promptly and following up consistently. Also, take a good look at your recurring expenses and look for patterns. When you understand your cash flow cycle, you can plan better and avoid surprises.

Set Up Smart Systems for Taxes and Compliance

Tax season shouldn’t be stressful, but it often is for small business owners who don’t prepare. From the moment you start earning revenue, you need a system to track income, expenses, and tax obligations. Set aside a percentage of your income for taxes every month. That way, you’re not scrambling when it’s time to pay.

Using accounting software can simplify this process. Many platforms let you categorize expenses, upload receipts, and even estimate taxes as you go. If your business grows or becomes more complex, hiring a bookkeeper or accountant can save you time and costly mistakes.

Create a Scalable Revenue and Pricing Strategy

A financial structure that works when you’re just starting might not hold up when your business is growing. That’s why your revenue model and pricing strategy need to be scalable. First, you need to know your true costs—product development, service delivery, customer acquisition—and build your pricing with those numbers in mind. If you’re guessing or underpricing just to compete, you could end up working harder for less as your business expands.

Test different pricing models, especially if you’re in a service-based or digital product space. Subscriptions, tiered pricing, and bundling are all ways to add recurring revenue and increase customer lifetime value. Think about how your pricing supports long-term growth, not just quick wins. When your revenue model scales easily, growth becomes more sustainable.

Keep Financial Literacy Front and Center

It’s easy to delegate your finances to a bookkeeper or bury your head in the operational side of your business. But staying financially literate can dramatically change the way you lead. It helps you ask better questions, make more informed decisions, and stay proactive instead of reactive.

Take time each month to review your financials. Look at your income statement, cash flow report, and balance sheet. Understand what the numbers are telling you. Follow trusted financial resources, read case studies, or even join entrepreneur groups where finances are part of the conversation. The more you understand how money works in your business, the better you can shape its future.

Creating a durable and scalable financial structure takes dedication and smart strategies. It’s the result of conscious decisions, consistent habits, and a willingness to stay involved with your numbers.

Financial success isn’t just about having capital—it’s about using it wisely, tracking it carefully, and always being ready for what’s next. When your structure is sound, growth becomes less risky and more strategic. Remember, a smart, sustainable plankeeps you in control every step of the way, and that is what every entrepreneur wants, isn’t it?

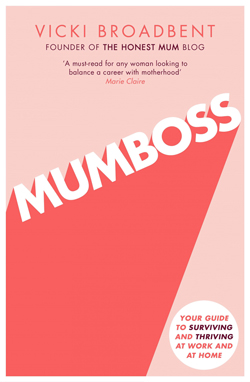

Buy my bestselling book in paperback or audio

My debut book is my guide to surviving and thriving at work and at home and offers insight into how to create a digital business or return to work with confidence.

Mumboss: The Honest Mum’s Guide to Surviving and Thriving at Work and at Home

(UK 2nd Edition)

Available on Amazon or Audible

The Working Mom: Your Guide to Surviving and Thriving at Work and at Home

(US/Canada Edition)

Available September 8th 2020. Order now on Amazon