Divorce can be emotionally challenging, and dividing assets, especially property, adds complexity. If you own property together, transferring equity may be necessary. Understanding this process is vital before making decisions.

In this article, we’ll guide you through the equity transfer process, helping you navigate this important step confidently.

What is Equity Transfer in a Divorce?

Transfer of Equity is the process of changing property ownership from one person to another. In a divorce, this typically occurs when one spouse transfers their share of the property to the other.

It’s a common method for dividing assets, particularly when a couple owns a home together. Essentially, transferring equity allows one spouse to “buy out” the other’s share, ensuring both parties receive a fair portion of the marital assets.

Key Considerations Before Agreeing to Terms

Before you agree to any terms regarding the transfer of equity, it’s important to think about several factors:

1. Valuation of the Property

You’ll need to know the current market value of the property. This is essential in determining how much equity each person holds and how much needs to be transferred. Getting a professional property valuation is a smart move.

2. Outstanding Mortgages or Debts

If there’s an outstanding mortgage on the property, this needs to be taken into account. The person receiving the equity transfer may have to take on the mortgage payments, or the mortgage might be paid off using other assets. Make sure to clarify this aspect to avoid future financial strain.

3. Legal and Tax Implications

Transferring equity in a divorce may have tax implications. You do not pay Stamp Duty Land Tax (SDLT) if the transfer is made between spouses as part of a formal agreement or court order related to divorce, dissolution, annulment or legal separation. However, it’s important to consult a solicitor or tax advisor to understand these details and avoid unexpected costs.

4. Future Financial Stability

Consider how this equity transfer will impact your future financial stability. Will taking on the full mortgage or the costs of the home leave you financially secure? Be sure that you’re making a decision that won’t cause financial strain down the line.

The Process of Transferring Equity

Step 1: Agreement Between Parties

Both spouses must come to an agreement about the terms of the equity transfer. This includes deciding who will keep the property, what amount of equity will be transferred, and how any outstanding debts will be managed.

Step 2: Legal Formalities

You’ll need to complete the necessary legal paperwork, which typically includes a deed of transfer. This document formalises the transfer of equity and must be signed by both parties. A solicitor can help ensure that the paperwork is correct.

Step 3: Land Registry

Once the transfer is agreed upon, the details must be registered with the Land Registry to reflect the change in ownership. This step ensures that the new ownership is officially recognised.

Conclusion

Transferring equity in a divorce is crucial for dividing assets fairly. It’s important to understand the process, including factors like property valuation, mortgages, and potential tax implications. Seek professional advice to make the process smoother. Before agreeing to terms, ensure you’re informed about how the transfer will affect your finances and future. If you need assistance, consulting a solicitor is wise to ensure everything is handled correctly and legally.

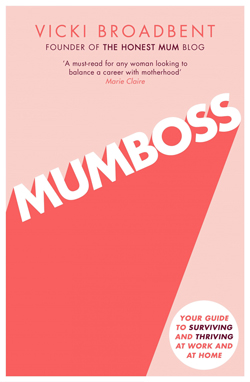

Buy my bestselling book in paperback or audio

My debut book is my guide to surviving and thriving at work and at home and offers insight into how to create a digital business or return to work with confidence.

Mumboss: The Honest Mum’s Guide to Surviving and Thriving at Work and at Home

(UK 2nd Edition)

Available on Amazon or Audible

The Working Mom: Your Guide to Surviving and Thriving at Work and at Home

(US/Canada Edition)

Available September 8th 2020. Order now on Amazon