You buy tiny sleepsuits, sort feeding gear, and stack nappies in the hallway cupboard. Then a letter from the bank lands, and paperwork jumps back onto your list. New parents often feel steady one minute, then stretched thin the next day.

A will is part of that quiet admin that protects your child if life turns suddenly. If your family has links to Australia, advice can vary by state and asset location. Attwood Marshall Lawyers explain those differences through their Sydney office , which can suit parents with NSW based ties.

Why Wills Matter More After A Baby Arrives

A will is not only about money, it is a plan for responsibility and timing. When a baby arrives, you also become the person who must name backup carers. If you die without a valid will, intestacy rules decide who receives assets and who applies to manage them.

Many couples assume their partner will automatically handle everything, but that is not always smooth. If you are unmarried, rules can be stricter, and family disputes can move fast. Even if you are married, delays can hit when accounts, property, or pensions sit in different places.

A will also reduces pressure on the people you trust most. It gives them a written record when they are grieving and sleep deprived. It can also lower the chance of arguments about your wishes, because names and roles are clear.

The Decisions A New Parent Should Write Down

Before you meet a solicitor, write down the choices you would explain to a close friend. This prep saves time and helps you speak clearly in the meeting. It also keeps you focused when your baby wakes mid sentence.

Here are five core decisions most new parents cover in a first will draft:

- Guardians for your child, including a first choice and a backup choice.

- Executors, who handle forms, debts, and distribution after death.

- Beneficiaries, including what goes to your partner versus your child.

- A trust plan for minors, so funds are managed until a chosen age.

- A short personal letter, to explain values, routines, or care notes.

For guardians, think about real logistics rather than sentiment alone. Consider where they live, school options, health needs, and work hours. Also ask yourself how your child would keep contact with grandparents and close relatives.

Getting The Formalities Right In The UK And Australia

A will only helps if it is valid where it needs to operate. In the UK, basic rules include signing in writing, plus two witnesses who watch you sign. The UK government’s guide on making a will sets out those core steps clearly.

Australia also has formal requirements, and they can differ by state and territory. Families with property in Australia often face added paperwork, even when the will is clear. That is common with a flat in London and a unit in Sydney, or an Australian superannuation benefit.

If you have assets in both countries, get advice on whether one will covers everything safely. In some cases, people use separate wills for separate jurisdictions, drafted to avoid accidental revocation. This is technical, but it matters, because one badly worded clause can cancel an earlier will.

Also think about where documents are signed and stored, and who can access them quickly. A valid will that no one can find can still lead to delays. Clear storage and a simple “where it is kept” note can save weeks.

How To Keep A Will Useful As Life Changes

New parent life changes fast, and your will should move with it. Review it after big events like a second child, a house purchase, or a separation. Also review it after a move overseas, because residency and asset location can change the legal picture.

Write down what you own and where it sits, including bank accounts, pensions, and property titles. List debts too, because executors deal with those before distributing gifts. Then keep that list separate from the will, so you can update it without re signing.

If you have NSW based ties, it can help to read public guidance on will making and related planning tools. NSW provides an overview through its Trustee and Guardian resources, which also point to related end of life documents.

Finally, keep your executor in the loop in a calm, practical way. Tell them where the signed will is stored, and who to contact for legal advice. You do not need a long speech, just a clear note.

How To Protect A Child’s Inheritance Until They Are Older

When a child inherits directly, the law usually limits their control until adulthood. That gap needs a plan so bills, school costs, and care needs are covered. A will can set up a trust so funds are managed for your child over time.

Choose a trustee who is organised, steady, and comfortable keeping clean records for years. A trustee handles money, follows the will’s rules, and reports to beneficiaries later. You can name one trustee, plus a backup, to avoid delays if plans change.

Think about what age makes sense for full access, because eighteen can feel too soon. Many parents pick staged access, such as part at twenty one, then the rest later. You can also allow trustee payments for education, medical costs, and basic living expenses.

Also check assets that do not always follow a will, such as pensions and insurance nominations. Some accounts pass by nomination forms, so update them after a birth or a move. If your life spans the UK and Australia, ask how each system treats these beneficiary records.

A Simple First Week Checklist

If you want a simple start, aim for progress rather than perfection this week. Use one short session during a nap, then stop when you feel your focus dropping. A few written notes are better than another tab left open.

Use this checklist as a quick prompt set:

- List your child’s full legal name and date of birth, plus any health needs.

- Choose first and second guardian options, and note why each choice works.

- Pick one executor, plus a backup, and confirm they are willing to act.

- Write a plain list of assets and debts, including locations and account types.

- Note any cross border links, like Australian property, super, or residency plans.

If you feel stuck, start with guardians and executors, because those choices guide the rest. Once those names are settled, the remaining decisions become simpler. You can then speak with a lawyer with a clear brief, even on little sleep.

A will for new parents is a short document that carries a lot of weight, because it names people and sets order. Keep it clear, keep it current, and store it so it can be found fast. If your family life spans the UK and Australia, get advice that matches where your assets and obligations sit. The payoff is quiet peace of mind during a busy season.

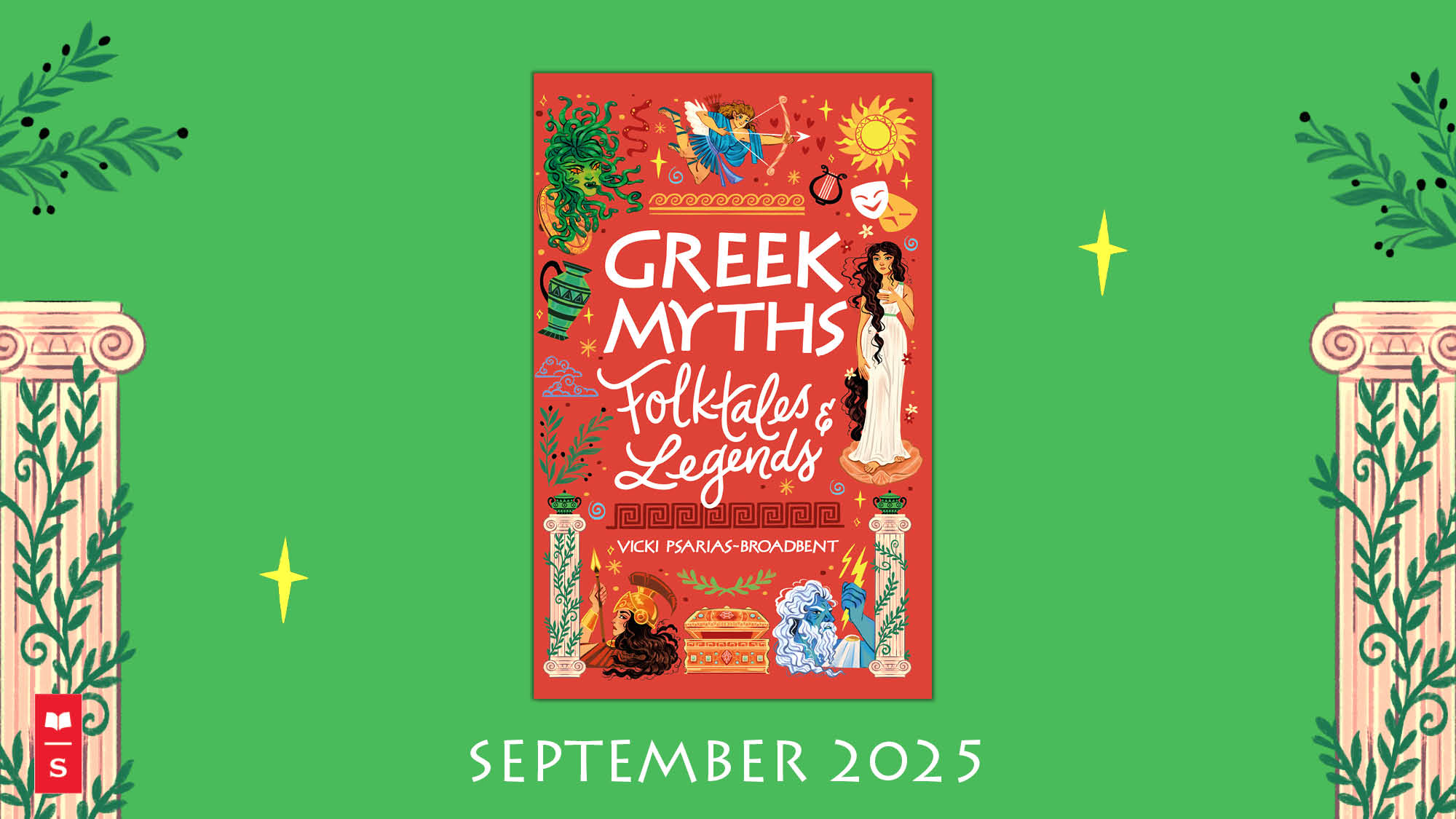

Pre-order my debut children’s book

Greek Myths, Folktales & Legends for 9-12 year olds

Published by Scholastic. Available on Amazon

Disclaimer: This content was automatically imported from a third-party source via RSS feed. The original source is: https://honestmum.com/what-to-know-about-wills-for-new-parents/. xn--babytilbehr-pgb.com does not claim ownership of this content. All rights remain with the original publisher.